Fake Id Kyc

2024-04-25 2024-04-25 0:11Fake Id Kyc

Fake Id Kyc

Connecticut Drivers License Fake Scannable

Massachusetts Drivers License Fake Scannable

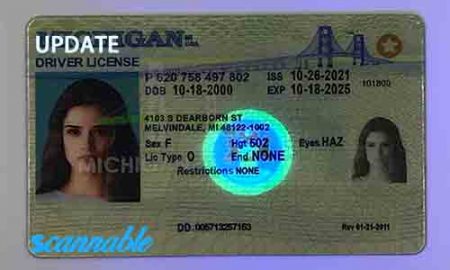

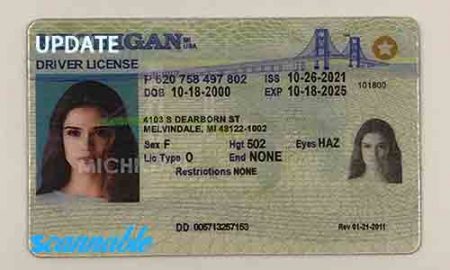

Michigan Fake Id

Washington Drivers License Fake Scannable

Title: The Risks and Consequences of Using Fake ID for KYC Verification

In today’s digital age, Know Your Customer (KYC) verification is a crucial process for businesses to ensure compliance with regulatory requirements and prevent fraudulent activities. However, some individuals may resort to using fake IDs to pass KYC checks and gain access to services they are not eligible for. This practice poses significant risks and consequences for both the individuals and the businesses involved.

KYC verification is designed to verify the identity of individuals by collecting and verifying personal information such as name, address, date of birth, and government-issued identification. This process helps businesses establish the identity of their customers, detect suspicious activities, and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Using a fake ID to pass KYC verification is a serious offense that can have severe consequences. Individuals who use fake IDs to deceive businesses may face criminal charges, fines, and even imprisonment. Businesses that fail to conduct proper KYC checks and verify the authenticity of customer identities may also face legal repercussions, including hefty fines and reputational damage.

The risks of using a fake ID for KYC verification are manifold. Firstly, using a fake ID is illegal and constitutes identity theft, fraud, and forgery, all of which are criminal offenses punishable by law. Individuals who engage in such activities may face legal consequences that can have lasting effects on their personal and professional lives.

Secondly, using a fake ID can result in financial losses for businesses. If an individual successfully passes KYC verification with a fake ID, they may gain access to services they are not eligible for, resulting in potential financial fraud and losses for the business. Moreover, businesses that fail to verify customer identities properly may be liable for facilitating fraudulent activities and may face regulatory sanctions and penalties.

Furthermore, using a fake ID for KYC verification undermines the integrity of the KYC process and erodes trust between businesses and their customers. KYC verification is designed to protect the interests of both businesses and customers by ensuring the security and authenticity of transactions. By using a fake ID to bypass KYC checks, individuals compromise the security and reliability of the verification process, putting businesses and legitimate customers at risk.

In addition to the legal and financial risks involved, using a fake ID for KYC verification can have detrimental effects on an individual’s reputation and credibility. Once an individual is caught using a fake ID, their trustworthiness and integrity may be called into question, affecting their relationships with businesses, employers, and the community at large. The stigma of being associated with fraud and deception can have far-reaching consequences on an individual’s personal and professional life.

To prevent the risks and consequences of using a fake ID for KYC verification, businesses must implement robust KYC procedures and verification mechanisms to detect and prevent fraud. By conducting thorough checks, verifying the authenticity of identification documents, and employing advanced technologies such as biometric verification and facial recognition, businesses can enhance the security and reliability of their KYC processes and protect themselves from fraudulent activities.

Individuals should also be aware of the risks and consequences of using a fake ID for KYC verification and refrain from engaging in such illegal activities. Instead of resorting to deceitful means, individuals should cooperate with businesses and provide accurate and verifiable information to facilitate smooth and secure transactions. By upholding the principles of honesty and integrity, individuals can protect themselves from legal penalties and reputational damage associated with using fake IDs for KYC verification.

In conclusion, using a fake ID for KYC verification poses serious risks and consequences for both individuals and businesses. It is essential for businesses to implement stringent KYC procedures and verification mechanisms to prevent fraud and protect themselves from legal and financial liabilities. Individuals must also refrain from using fake IDs and cooperate with businesses to establish their identities truthfully and transparently. By upholding the principles of integrity and honesty, both businesses and individuals can uphold the security and reliability of the KYC process and prevent fraudulent activities.