Fake Tax Id Number Uk

2024-04-29 2024-04-29 7:24Fake Tax Id Number Uk

Fake Tax Id Number Uk

Germany Id Card Fake Scannable

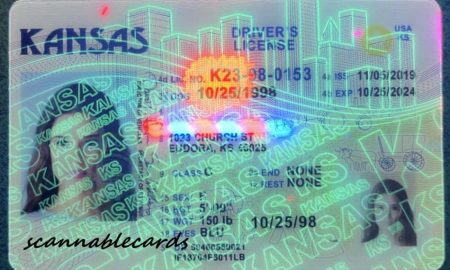

Kansas Fake Id

Michigan Fake Id

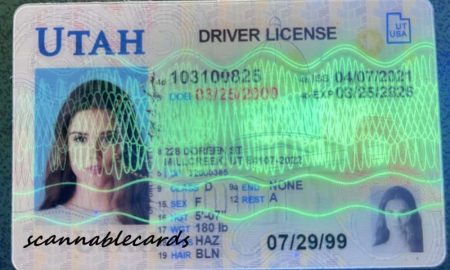

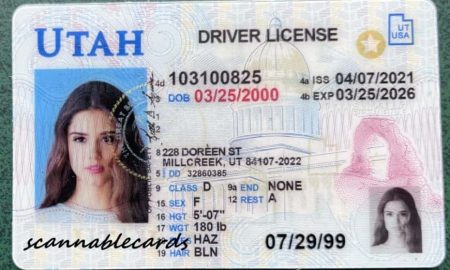

Utah Fake Id

Tax identification numbers are crucial for individuals and businesses alike to properly report and file their taxes. In the United Kingdom, individuals are assigned a unique National Insurance number while businesses are assigned a unique tax identification number. Unfortunately, there are individuals and businesses who attempt to deceive the government by using fake tax identification numbers. This unethical practice not only jeopardizes the integrity of the tax system but also puts legitimate taxpayers at risk of facing consequences for unknowingly using a fake tax identification number.

A fake tax identification number in the UK is typically a random set of numbers or a fabricated number that does not correspond to any legitimate tax identification number issued by HM Revenue & Customs (HMRC). Individuals and businesses may use fake tax identification numbers to evade paying taxes, commit fraud, or engage in other illegal activities. However, using a fake tax identification number is a serious offense that can result in severe penalties, including fines, imprisonment, and legal action.

There are several ways in which individuals and businesses may obtain a fake tax identification number in the UK. One common method is to purchase a fake tax identification number from fraudulent websites or underground networks. These websites often claim to provide legitimate-looking tax identification numbers that are actually fake and have no validity. Individuals and businesses may also attempt to create their own fake tax identification numbers by manipulating existing numbers or generating random numbers that resemble legitimate tax identification numbers.

Using a fake tax identification number in the UK can have serious consequences for individuals and businesses. If HMRC discovers that an individual or business has used a fake tax identification number, they may launch an investigation into the individual or business’s tax affairs. This can result in fines, penalties, and even criminal charges for tax evasion. In addition, individuals and businesses who use fake tax identification numbers may be subject to further scrutiny by HMRC, leading to additional audits and investigations.

It is important for individuals and businesses in the UK to be aware of the consequences of using a fake tax identification number. By using a fake tax identification number, individuals and businesses are not only breaking the law but also putting themselves at risk of serious financial and legal repercussions. It is always best to comply with tax laws and regulations and to use legitimate tax identification numbers when filing taxes or conducting business activities.

In conclusion, using a fake tax identification number in the UK is a serious offense that can result in severe penalties and legal consequences. Individuals and businesses should always use legitimate tax identification numbers issued by HMRC and comply with tax laws and regulations to avoid facing any negative repercussions. It is important to maintain the integrity of the tax system and to be honest and transparent in all tax-related matters. By following the law and using legitimate tax identification numbers, individuals and businesses can avoid the risks and consequences associated with using a fake tax identification number.