Fake Upi Id

2024-04-29 2024-04-29 17:25Fake Upi Id

Fake Upi Id

Croatia Id Card Fake Scannable

Georgia Drivers License New Fake Scannable

Israel Id Card Fake Scannable

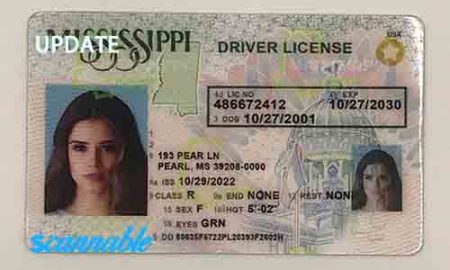

Mississippi Fake Id

In the age of digital transactions, online banking and payment systems have become an integral part of our everyday lives. One such popular payment system in India is the Unified Payments Interface (UPI), which allows users to transfer money instantly between bank accounts with just a few clicks on their smartphones. UPI has gained immense popularity due to its ease of use, convenience, and security features.

However, like any other digital platform, UPI is not immune to scams and frauds. One common type of fraud that has been on the rise is the use of fake UPI IDs to trick unsuspecting users into transferring money to scamsters. In this article, we will explore the phenomenon of fake UPI IDs, how they are used to deceive users, and what steps can be taken to protect oneself from falling victim to such scams.

What is a fake UPI ID?

A UPI ID is a unique identifier that is linked to a user’s bank account and is used to send or receive money through the UPI platform. Typically, a UPI ID is a combination of the user’s mobile number and the name of their bank, making it easy for users to identify and transfer money to the right recipient. However, scammers have found ways to create fake UPI IDs that closely resemble legitimate ones, with the intention of deceiving users into sending them money.

How do scammers use fake UPI IDs?

Scammers use various tactics to trick users into transferring money to fake UPI IDs. One common method is to send phishing messages or emails to users, claiming to be from a legitimate organization or a friend in need of urgent financial assistance. These messages often contain a fake UPI ID and a convincing reason for why the user should transfer money to that ID immediately.

Another strategy employed by scammers is to create fake websites or mobile apps that mimic popular banking or payment platforms. These fake platforms may prompt users to enter their UPI ID and other sensitive information, which can then be used to carry out fraudulent transactions.

In some cases, scammers may even impersonate a trusted contact of the user and request money to be sent to a fake UPI ID. This type of social engineering tactic preys on the user’s trust and familiarity with the supposed sender, making it more likely for them to fall for the scam.

How to protect yourself from fake UPI ID scams?

To protect yourself from falling victim to fake UPI ID scams, it is essential to exercise caution and follow some simple security measures. Here are a few tips to help you stay safe while using UPI:

1. Verify the identity of the recipient: Before sending money to a UPI ID, always double-check the recipient’s details, such as their name, bank, and mobile number. If you are unsure about the recipient’s identity, it is better to ask for additional verification or refrain from making the transaction.

2. Do not share OTPs or PINs: Never share your UPI PIN or OTP (One-Time Password) with anyone, as this information can be misused to carry out unauthorized transactions. Legitimate banks and payment platforms will never ask you to disclose sensitive information over the phone or through unsolicited messages.

3. Be wary of unsolicited requests: If you receive a request for money from an unknown or unverified contact, proceed with caution and verify the sender’s identity before making any transfers. Do not hesitate to reach out to the person directly to confirm the request and avoid falling for potential scams.

4. Use official banking apps and websites: To minimize the risk of encountering fake UPI IDs, make sure to download banking apps and access payment platforms only from official sources, such as the Google Play Store or Apple App Store. Avoid clicking on suspicious links or downloading apps from unknown sources to protect your personal information.

5. Stay informed about common scams: Keeping yourself updated about the latest types of scams and frauds can help you identify potential threats and take proactive measures to safeguard your financial data. Stay vigilant and educate yourself on how scammers operate to avoid becoming a victim of their deceitful tactics.

In conclusion, fake UPI IDs pose a significant threat to the security of online transactions and can lead to financial loss if not detected in time. By being mindful of the warning signs and taking necessary precautions, users can protect themselves from falling prey to fake UPI ID scams. Remember to always verify the identity of the recipient, refrain from sharing sensitive information, and stay informed about common scams to stay safe while using UPI for digital payments.